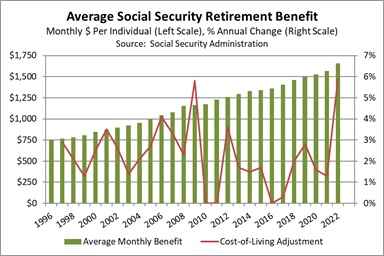

Asset Allocation Weekly - The Inflation Adjustment for Social Security Benefits in 2022 (October 22, 2021) - Confluence Investment Management

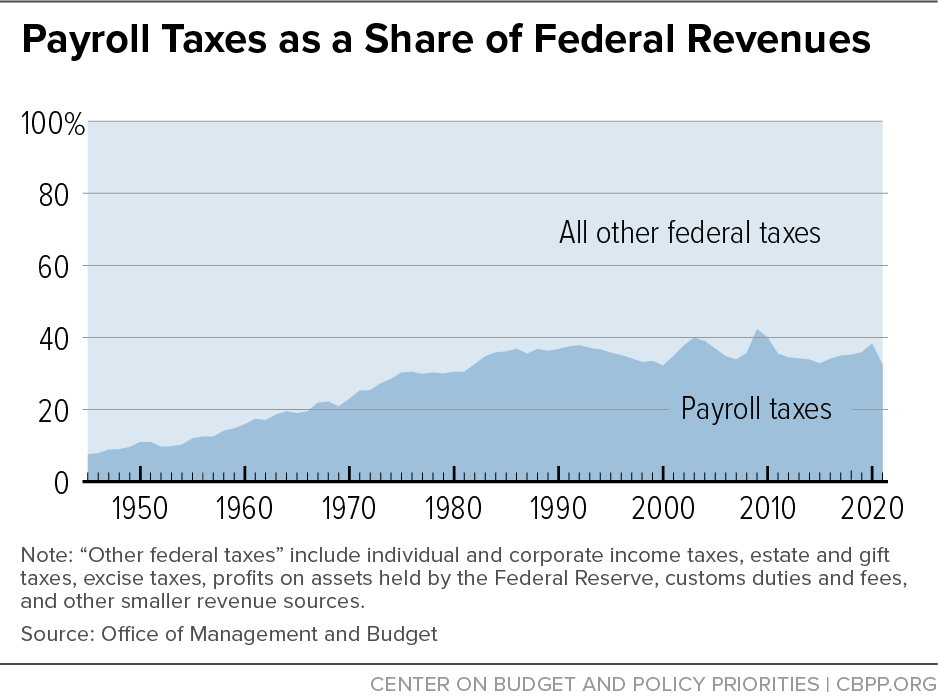

Wage Cap Allows Millionaires to Stop Contributing to Social Security on February 24, 2022 - Center for Economic and Policy Research

Scrap the Cap: Strengthening Social Security for Future Generations – Social Security Works – Washington

Social Security Administration Announces 2022 Payroll Tax Increase | ERI Economic Research Institute

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)